1. Apple's "China Anxiety” and Ali's "Technological breakthrough”

It is no accident that Apple chose to cooperate with Alibaba to develop the AI capabilities of the Chinese version of the iPhone. This seemingly win-win cooperation reflects the deep anxiety and strategic game of the two technology giants under the tide of the times.

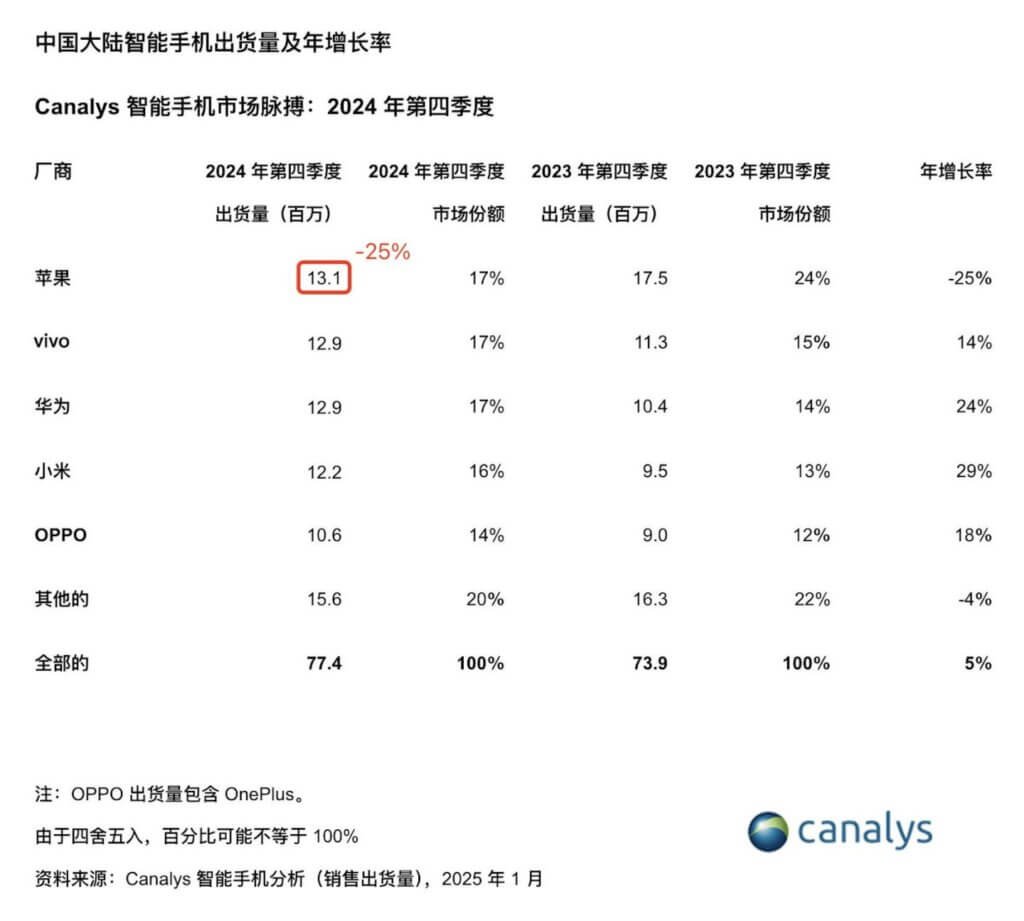

Apple's decline in the Chinese market has lasted for three years: shipments from mainland China in the fourth quarter of fiscal year 2024 plunged by 25% compared to the fourth quarter of 2023, its market share fell by 7 percentage points to 17%, and its annual shipments also fell by 25% (according toCanalys dataDisplay).

Facing the strong rise of local brands such as Huawei and Xiaomi, Apple's proud hardware innovation has gradually failed, and the lateness of the generative AI wave has made its software ecosystem appear “clumsy.” Cook had to admit that Apple's AI feature “has performed better in related markets after it was launched in the United States,” but what Chinese users need is a better understanding of Chinese and more localized services. From the initial test of Baidu to the final choice of Ali, Apple's repeated trade-off exposed its strangeness and compromise to the Chinese market-technical standards can be globalized, but user habits must be “Sinicized.”

On the other hand, Ali, this cooperation is a high-profile “renaming” of its AI technology. The Tongyi Qianwen (Qwen) large model has long been criticized as “heavy on business and light on technology”, and Apple's endorsement is undoubtedly a recognition of its technical strength. More importantly, Ali took this opportunity to break into Apple's closed ecosystem in one fell swoop, reaching 200 million high-net-worth iPhone users, opening up new scenarios for AI commercialization. This strategy of ”borrowing a ship to go to sea“ is not only a dimension-reducing blow to the domestic large-scale model melee, but also a key bargaining chip to prove its ”technical gold content" to the capital market.

2. The “sweet spot” and “reef” of technical cooperation

On the surface, this is a perfect complement: Apple needs Ali's localization capabilities, and Ali longs for Apple's hardware entry. But after delving into the details of the cooperation, the contradiction has begun to emerge.

Ali Tongyi Qianwen's victory was not a simple technical advantage, but a contest of comprehensive strength. Apple has tested models such as Baidu and DeepSeek, but Baidu was eliminated due to insufficient semantic recognition capabilities, while DeepSeek was abandoned due to “the team's lack of experience in supporting major customers.” This reveals a cruel reality: in the AI landing stage, technical performance is only the ticket, and engineering capabilities and resource reserves are the key to victory. Alibaba Cloud's double eleven-level stress resistance and full-stack technology ecology eventually became Apple's ”security brand".

But hidden dangers also follow. How is Apple's “closure” compatible with Ali's “openness”? For example, Tongyi Qianwen, as an open source model, will its iteration direction be limited by the Apple ecosystem? As another example, how is the boundary between the ownership of user data and the protection of privacy divided? There are no clear answers to these questions, and the progress of the Chinese regulatory authorities' review of AI functions (the cooperation plan has been submitted for review) may also affect the implementation schedule. What is even more alarming is that Apple's ”multi-country AI diplomacy" strategy-cooperating with Google and OpenAI in Europe and the United States, and joining forces with Ali in China-may lead to the fragmentation of technical standards, which will ultimately lead to the fragmentation of the global user experience.

3. Industry shock wave: the “critical Point” of AI mobile Phones and the new paradigm of competition

This work may reshape the competitive logic of the smartphone industry.

Apple's compromise marks the end of the era of “hardware hegemony”. When the premium space of the iPhone is squeezed by hardware homogenization, AI service capabilities become a new moat. By empowering Apple, Ali actually participated in the rulemaking of the world's top consumer electronics ecosystem, which is a milestone for Chinese technology companies. As analysts have said, this move will “promote the further intelligence and personalization of smart phones” and force other manufacturers to accelerate the development of AI-native applications.

But this may also exacerbate the Matthew effect in the industry. Small and medium-sized manufacturers neither have the financial resources to develop their own large models, nor are they favored by giants, and their living space will be further compressed. At the same time, Huawei's Pangu big model and Xiaomi's MiLM are already eyeing, and an “arms race” around AI mobile phones is about to erupt. Ali's cooperation with Apple may just be the trigger for this war.

4. Conclusion: An experiment to redefine the pattern of scientific and technological power

The marriage between Apple and Ali is essentially a new type of technology alliance under the ebb tide of globalization-western brands leverage local giants to solve the geographical dilemma, while Chinese companies compete for the right to speak through technology output. If this work is successful, it will prove that technological power in the AI era can transcend ideological barriers and form “symbiotic innovation”; if it fails, it may intensify the confrontation between the science and technology camps.

However, the real test lies in: when the aura of technology fades, are users willing to pay for the combination of “Apple Core + Alibaba Brain”? The answer may be hidden in the upcoming iOS 18.4. But in any case, this work has opened a crack in the global revaluation of China's technology assets-the capital market has used the enthusiasm of Ali's stock price to skyrocket by 8% in a single day and climb by 50% in three months to cast a vote of confidence in “China's AI power”.

Comment List (0):

Load More Comments Loading. . .